All about Personal Loans copyright

Table of ContentsLittle Known Questions About Personal Loans copyright.Some Of Personal Loans copyrightFascination About Personal Loans copyrightLittle Known Facts About Personal Loans copyright.Excitement About Personal Loans copyright

Payment terms at most personal lending lending institutions range in between one and 7 years. You receive all of the funds at once and can utilize them for virtually any purpose. Debtors frequently utilize them to fund an asset, such as a car or a watercraft, repay debt or assistance cover the price of a significant expense, like a wedding celebration or a home restoration.

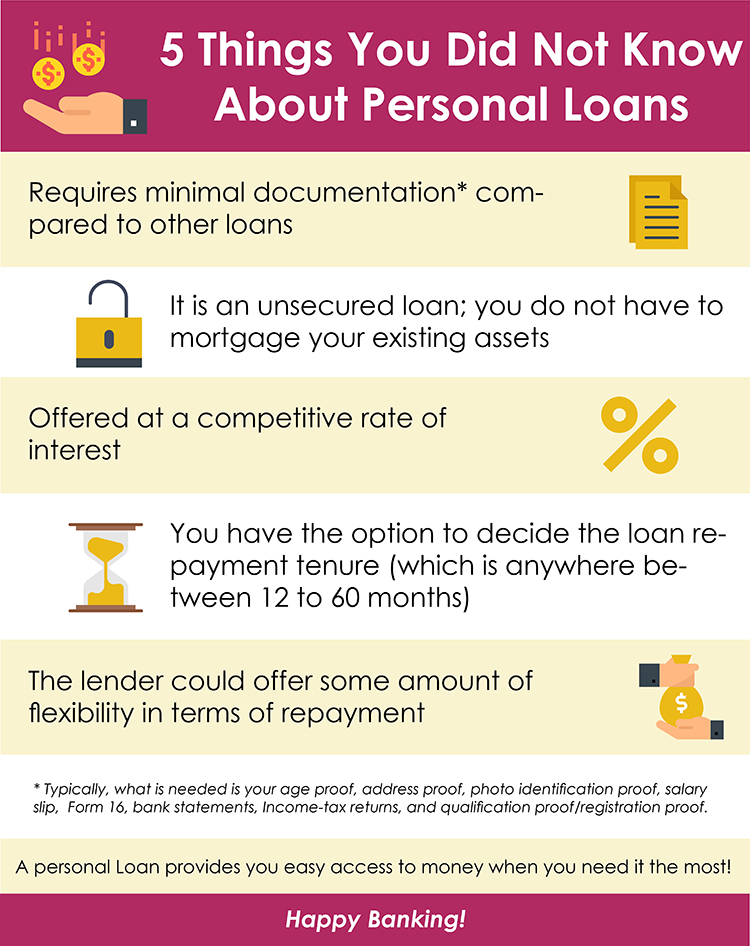

Personal loans included a taken care of principal and passion monthly repayment for the life of the loan, determined by accumulating the principal and the passion. A fixed rate provides you the protection of a predictable monthly payment, making it a prominent option for settling variable rate bank card. Payment timelines differ for individual loans, however customers are usually able to choose payment terms between one and 7 years.

Everything about Personal Loans copyright

You may pay a preliminary origination fee of approximately 10 percent for an individual finance. The charge is generally deducted from your funds when you settle your application, minimizing the quantity of cash you pocket. Personal lendings rates are extra straight tied to short-term prices like the prime rate.

You may be used a lower APR for a much shorter term, since lenders understand your balance will be settled much faster. They may bill a higher price for longer terms knowing the longer you have a lending, the most likely something might alter in your finances that might make the repayment expensive.

A personal finance is likewise a good option to making use of credit cards, given that you borrow money at a set price with a certain payback date based on the term you pick. Remember: When the honeymoon is over, the regular monthly payments will find here be a tip of the cash you spent.

The Ultimate Guide To Personal Loans copyright

Prior to tackling debt, use a personal lending repayment calculator to assist budget plan. Collecting quotes from numerous lenders can help you detect the most effective deal and potentially save you interest. Contrast interest rates, charges and loan provider credibility before looking for the car loan. Your credit history is a large aspect in determining your qualification for the car loan in addition to the rate of interest.

Prior to applying, understand what your rating is to ensure that you know what to anticipate in terms of expenses. Watch for hidden costs and charges by reading the lending institution's conditions web page so you do not finish up with less money than you require for your financial goals.

Individual finances call for evidence you have the credit score account and earnings to settle them. They're easier to certify for than home equity lendings or various other protected financings, you still require to show the lender you have the methods to pay the lending back. Personal financings are much better than charge card if you desire an established monthly settlement and require every one of your funds simultaneously.

All About Personal Loans copyright

Debt cards might additionally use rewards or cash-back choices that individual finances don't.

Some lending institutions might likewise charge costs for personal car loans. Individual car loans are car loans that can cover a variety of individual expenses. You can discover individual car loans via financial institutions, lending institution, and online lenders. Personal financings can be secured, suggesting you need collateral to obtain money, or unprotected, with no security needed.

As you invest, your readily available credit score is reduced. You can then boost readily available credit rating by making a repayment towards your credit rating line. With an individual finance, there's typically a set end date through which the loan will certainly be paid off. A line of credit, on the various other hand, might stay check my site open and readily available to you forever as lengthy as your account continues to be in good standing with your lender - Personal Loans copyright.

The cash obtained on the loan is not taxed. If the lender forgives the finance, it is thought about a terminated financial obligation, and that quantity can be tired. Individual finances might be safeguarded or unsafe. A safeguarded personal car loan requires some kind of security as a condition of borrowing. For circumstances, you may secure an individual finance with site link money properties, such as an interest-bearing account or deposit slip (CD), or with a physical property, such as your cars and truck or watercraft.

Some Ideas on Personal Loans copyright You Need To Know

An unsecured personal financing calls for no security to obtain cash. Financial institutions, debt unions, and online loan providers can supply both protected and unsafe individual financings to qualified debtors. Financial institutions typically think about the latter to be riskier than the former since there's no collateral to accumulate. That can indicate paying a greater rate of interest for a personal financing.

Once again, this can be a financial institution, credit score union, or on the internet individual lending lender. If accepted, you'll be given the financing terms, which you can accept or turn down.